Navigating the Tech Landscape in 2025

A tech industry report reveals a sector in dramatic flux, where artificial intelligence drives unprecedented change while market forces create new challenges. With an $18.352 trillion market capitalization—nearly 30% of the S&P 500—the tech sector is the most influential force in global markets.

Key Tech Industry Report Findings:

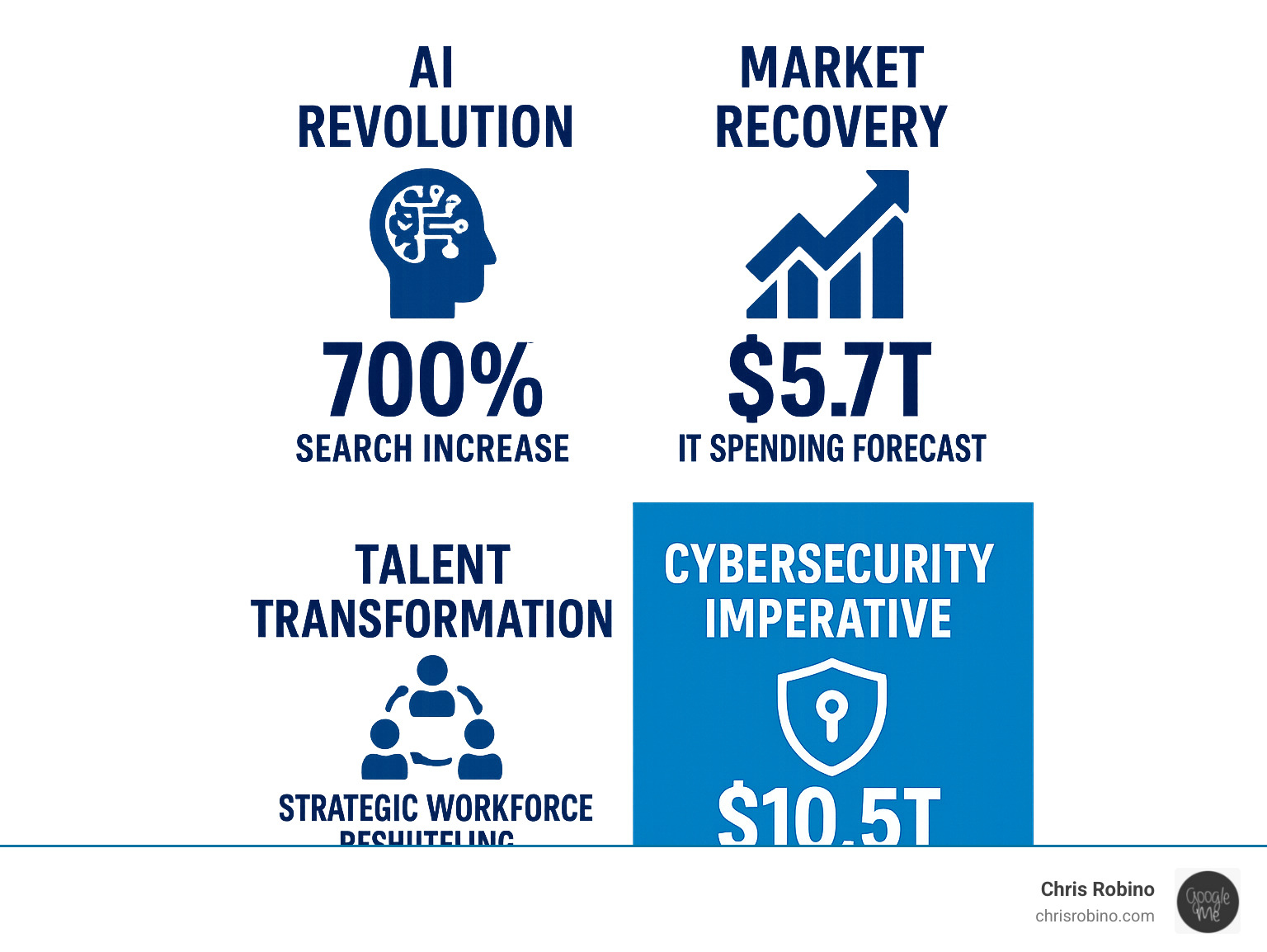

- AI Investment Surge: Generative AI saw a 700% spike in Google searches and a sevenfold investment increase, despite a 30-40% decline in overall tech equity investments.

- Market Correction: S&P 500 tech stocks lost 32% of their value in 2022, but IT spending is forecast to hit $5.7 trillion in 2025.

- Talent Reshuffling: In 2024, 546 tech companies conducted layoffs affecting 152,074 workers, creating skills gaps despite strong long-term demand.

- Cybersecurity Crisis: Cybercrime costs are projected to reach $10.5 trillion by 2025, driving massive security investments.

- Enterprise Adoption: 25% of companies are expected to launch AI pilots by 2025, growing to 50% by 2027.

The data shows we’re witnessing the most significant technological shift since the internet’s birth. While 2022-2023 brought market corrections, 2024 marked the beginning of AI’s mainstream adoption.

Global IT spending growth of 9.3% in 2025 signals a strong recovery, with data center and software segments leading. Yet, this growth brings complexity—companies must balance innovation with integration, talent acquisition with cost management, and growth with cybersecurity risks.

As Chris Robino, a Digital Strategy Leader with over two decades of experience in AI and search optimization, I translate tech industry report insights into actionable business strategies. My work shows that success today requires both strategic foresight and practical execution.

Comprehensive Tech Industry Report: Market Health and Investment Climate

The technology sector has always mirrored the broader economy, amplifying market sentiment. Our latest tech industry report reveals a story of resilience, where market corrections gave way to strategic realignment and renewed investment focus.

The Financial Pulse: From Correction to Cautious Optimism

In 2022, the S&P 500 tech sector lost nearly 32% of its value as rising interest rates made capital more expensive. Subsequently, technology equity investments fell by 30-40% in 2023, totaling around $570 billion. However, market corrections often clear the deck for the next wave of innovation.

A recovery is already underway. IT spending is forecast to reach $5.7 trillion by 2025, signaling sustained business confidence in technology. While overall investment declined, smart money flowed into promising areas, with Generative AI seeing a sevenfold increase in investments. M&A activity also remained robust, particularly in enterprise IT, as lower valuations created attractive opportunities for strategic buyers.

The tech sector’s $18.352 trillion market capitalization represents nearly 30% of the S&P 500, making it impossible to ignore. For deeper insights, you can analyze Visualizing S&P 500 performance. The resilience of segments like Cloud-Based Computing continues to underpin the sector’s long-term potential.

The Talent Equation: Layoffs, Skills Gaps, and the Hunt for Expertise

The financial turbulence created a complex talent landscape. In 2023, 1,193 tech companies laid off 264,220 workers, followed by 546 companies affecting 152,074 workers in 2024, according to Layoffs tracker data. Job postings for tech roles declined by 26% in 2023, a steeper drop than the 17% global decrease.

However, many of these layoffs were about “right-sizing” after rapid pandemic-era hiring, not fundamental weakness. The underlying demand for tech talent remains strong, with job postings for tech trends still up 8% from 2021 to 2023. The core challenge is not a lack of jobs but a massive skills gap, as fewer than half of potential candidates possess the high-demand skills employers need.

This creates a paradox: while some areas shed jobs, others desperately hunt for qualified professionals. Today’s tech professionals prioritize benefits, job security, and development, forcing employers to rethink their value propositions. The companies succeeding are those investing in upskilling and creating comprehensive offerings to attract top talent, a dynamic seen in regions like British Columbia, as detailed in this report on the tech talent shortage.

The AI Revolution: How Generative AI is Reshaping Industries

In any tech industry report today, one trend dominates: Artificial Intelligence, specifically Generative AI. This is not a fad but a fundamental shift changing how businesses operate and how we experience daily life. Unlike previous automation waves, Generative AI creates something new, moving us toward intelligent systems that can think, create, and adapt.

Dissecting the Latest Tech Industry Report on AI

The numbers are staggering. Google searches for Generative AI spiked almost 700% from 2022 to 2023, reflecting massive business urgency. While overall tech investments declined, Generative AI saw a sevenfold increase in funding. Technical capabilities are also evolving rapidly, with Large Language Models (LLMs) now processing context windows up to two million tokens—a huge leap in contextual understanding.

Worldwide AI spending is forecast to reach $632 billion by 2028, according to the Worldwide AI spending forecast. We are in the “AI phase of computing,” where AI will become an invisible force like electricity, making everything smarter and more intuitive.

Key Applications and Use Cases of Generative AI

The change is happening now. Content creation has been revolutionized, with AI drafting everything from marketing copy to legal documents. In software development, 62% of developers are already using AI code generators to accelerate coding and debugging, a trend we explore in More on AI and automation. Other key applications include:

- Customer service chatbots that offer natural, complex query resolution.

- Drug findy, where AI analyzes vast datasets to identify new drug candidates.

- Personalized marketing that creates highly relevant campaigns.

- Generative UI, which creates adaptive user interfaces for outcome-oriented design.

- Agentic AI, or autonomous systems that complete multi-step tasks with minimal oversight.

As one tech industry report noted, creating value with AI requires changing work processes. Success depends on integrating AI into workflows. For companies building SEO strategies, this means creating content with deep topical authority and using structured data to excel at Answer Engine Optimization (AEO), ensuring content is surfaced by AI-powered search.

Key Technology Trends for 2025 and Beyond

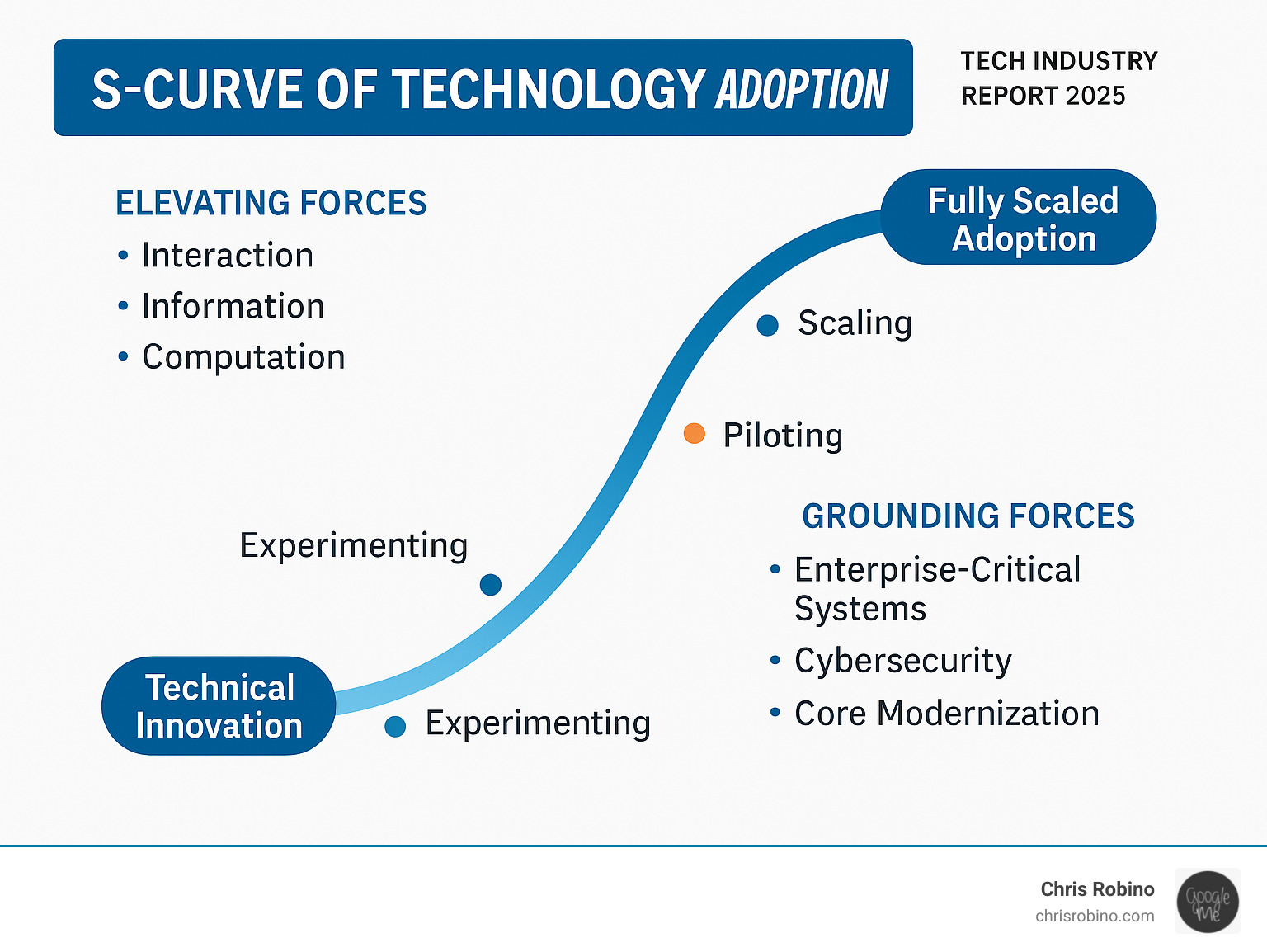

Looking ahead, the tech landscape is shaped by powerful “elevating forces” like interaction and computation, grounded by enterprise-critical systems and cybersecurity. Our latest tech industry report highlights several pivotal trends that will define 2025 and beyond.

The Future is in the Cloud (and at the Edge)

Cloud computing continues its advance, with public cloud spending forecast to double by 2028. Public cloud infrastructure spending is expected to grow 30.4% to $108.3 billion in 2024. However, a “private cloud comeback” is reshaping the landscape. Due to cost, security, and compliance concerns—especially with AI models—organizations are adopting hybrid cloud strategies. Spending on private cloud infrastructure is also growing, projected at 12.8% to reach $30 billion. This shift brings FinOps into focus to manage costs, with some even exploring cloud repatriation. Meanwhile, edge computing is gaining momentum, with spending forecast to reach $378 billion in 2028 to support IoT and real-time AI. The future is a distributed computing fabric, a topic we’ve covered in Moving from Ops System to Browser-Based to the Clouds.

Fortifying the Digital Field: The Cybersecurity Imperative

As technology integrates into every business aspect, the threat landscape expands. Cybersecurity is a fundamental business imperative, with our tech industry report projecting cybercrime costs to hit $10.5 trillion by 2025. This threat includes financial loss, reputational damage, and operational disruption. Companies are struggling with “security debt”—unaddressed vulnerabilities that increase risk. Managing privileged access is paramount, and emerging threats like quantum computing require proactive defense strategies. Fortunately, AI is also a formidable weapon in this battle, enabling real-time threat detection and automated response. For more, the State of Cybersecurity 2025 report offers comprehensive insights.

Green Tech: Sustainability and Geopolitical Shifts

The tech industry is struggling with its physical footprint and a fragmented world. Data centers are massive energy consumers, making decarbonization and climate resilience critical. Environmental risks like wildfires and floods are now real operational concerns. Geopolitical tensions are also reshaping the global tech supply chain, promoting “friend-shoring” and manufacturing relocations to build resilience. The geopolitics of tech are becoming as important as the technology itself, influencing everything from chip manufacturing to data storage.

Enterprise Adoption: From Pioneering Innovation to Critical Systems

The journey of new technology within an enterprise follows an S-curve, from innovation and piloting to full-scale adoption. Our latest tech industry report shows many innovations are now in the critical scaling phase, presenting both opportunities and challenges.

Navigating the Technology Adoption S-Curve

Understanding a technology’s adoption stage is crucial for strategic planning. In 2023, several technologies were firmly in the scaling stage. Cloud and edge computing led with 48% adoption, followed by advanced connectivity (37%). Notably, generative AI achieved 36% adoption, with 25% of companies already scaling its use. Other scaled technologies include applied AI (35%), next-generation software development (31%), and digital trust and cybersecurity (30%). This maturation requires long-term planning, investment, and a willingness to adapt organizational processes.

Overcoming Integration and Modernization Problems

The biggest hurdle for most businesses is integrating new tech with existing, complex systems, a problem often compounded by “technical debt.” Process redesign is a critical success factor, as generative AI’s value comes from changing workflows, not just deployment. This requires business diagnostics and clear targets. Change management is equally important, as technology adoption is ultimately about people. Coherent change programs and training are crucial for employee acceptance. Finally, gaining insights from data is a priority when modernizing, allowing businesses to make data-driven decisions and Creating harmony in numbers by making data actionable.

Adapting Digital Strategy: SEO for Emerging Tech

The rise of generative AI is reshaping search engines, creating a need to adapt digital strategies. The shift is toward Answer Engine Optimization (AEO), driven by features like AI Overviews (AIOs). These AI-generated answers appear at the top of search results, meaning SEO must now focus on being featured within them. This requires optimizing for complex, informational keywords and prioritizing Google’s E-E-A-T signals (Experience, Expertise, Authoritativeness, Trustworthiness). To succeed, businesses must build topical authority in new tech verticals and leverage structured data to help search engines understand complex concepts.

SEO Strategies That Perform Well for Large Companies

For large companies, a robust SEO strategy must be multifaceted. Key tactics include:

- Develop content hubs and pillar pages to establish deep topical authority.

- Implement advanced internal linking to distribute authority and guide users.

- Leverage structured data to improve visibility and enable rich results for emerging tech.

- Invest in technical SEO (speed, mobile-friendliness, crawlability) to ensure a strong foundation.

- Build a strong backlink profile through thought leadership and high-quality content.

- Prioritize E-E-A-T signals by showcasing credentials, case studies, and expert insights.

- Use data-driven keyword research to identify new opportunities.

- Optimize for voice and AI-powered search with conversational language and structured answers.

Dominant Sub-Sectors and Key Industry Drivers

Within the vast technology landscape, certain sub-sectors consistently drive growth. Our latest tech industry report highlights the critical roles of semiconductors and software, alongside the importance of strategic collaborations.

| Sub-Sector | Market Weight (S&P 500) | YTD Return |

|---|---|---|

| Semiconductors | 29.44% | 75.82% |

| Software – Infrastructure | 27.58% | 18.26% |

| Consumer Electronics | 18.46% | 12.97% |

| Software – Application | 10.38% | 0.48% |

| Information Technology Services | 4.13% | -2.31% |

The Engines of Growth: Semiconductors and Software

To understand the tech industry’s direction, follow the money—currently flowing into semiconductors and software. These two sectors are the powerhouses of our digital change.

Semiconductors are experiencing a remarkable rebound, with a 29.44% market weight and a 75.82% YTD return. This growth is driven by soaring demand for specialized AI chips, as well as needs in the automotive and industrial markets. As detailed in this report on AI, auto, and industrial markets spurring chip demand, every AI query and autonomous vehicle decision relies on powerful semiconductors.

Software remains the other massive growth engine. The Software-as-a-Service (SaaS) industry is set to hit $317.55 billion by the end of 2024, democratizing access to powerful tools. Software – Infrastructure commands a 27.58% market weight, while Software – Application holds 10.38%, forming the invisible backbone of modern business.

Strategic Alliances and Ecosystems

In today’s interconnected tech world, a lone wolf approach is ineffective. The most successful companies build powerful ecosystems through strategic partnerships. We’re seeing fascinating alliances, such as IBM and AWS collaborating on AI and hybrid cloud, Salesforce and IBM targeting AI and data improvements, and Google Cloud partnering with Hugging Face to attract AI developers.

These tech ecosystems represent a fundamental shift from isolated competition to integrated collaboration. The rise of platform offerings that combine capabilities from various suppliers accelerates innovation, expands market reach, and creates synergistic solutions that no single company could achieve alone.

Conclusion: Your Strategic Next Steps in a Shifting Tech World

This tech industry report reveals an industry at a crossroads of unprecedented opportunity and complex challenges. We’ve seen market volatility test resilience, a talent landscape reshaped by strategic changes, and the unstoppable force of Artificial Intelligence.

The numbers tell a story of evolution: while the S&P 500 tech sector lost 32% of its value in 2022, AI investment surged sevenfold. Companies are becoming more strategic and intentional with their investments.

The landscape ahead demands both vision and pragmatism. The $632 billion projected for AI spending by 2028 signals a new era where intelligence becomes invisible infrastructure. Here are the key takeaways for your strategy:

- Resilience is the defining competitive advantage. Organizations that adapted to market corrections, supply chain disruptions, and talent challenges are now positioned to lead.

- Talent remains the ultimate differentiator. Despite layoffs, the skills gap is widening. Smart organizations are using this as an opportunity to attract top talent and invest in upskilling.

- Integration separates winners from wannabes. Real value comes from seamless integration with existing systems and thoughtful change management, not just from deploying new technology.

- Ecosystems drive exponential growth. The most successful companies are building strategic alliances, like those between IBM and AWS or Google Cloud and Hugging Face. Collaboration is the new competition.

Success will require balancing strategic foresight with operational agility. As someone who has guided organizations through multiple technology transitions, I know how the right strategy can transform challenges into advantages.

The future belongs to organizations that accept continuous learning and strategic planning. For deeper insights, explore Optimize Everything by Chris Robino.

Ready to transform these insights into action? Let’s work together to build a technology strategy that doesn’t just keep pace with change—it leads it. Start your next project with us and find how the right approach can turn industry disruption into your competitive advantage.