Why Media Industry Analysis Matters More Than Ever

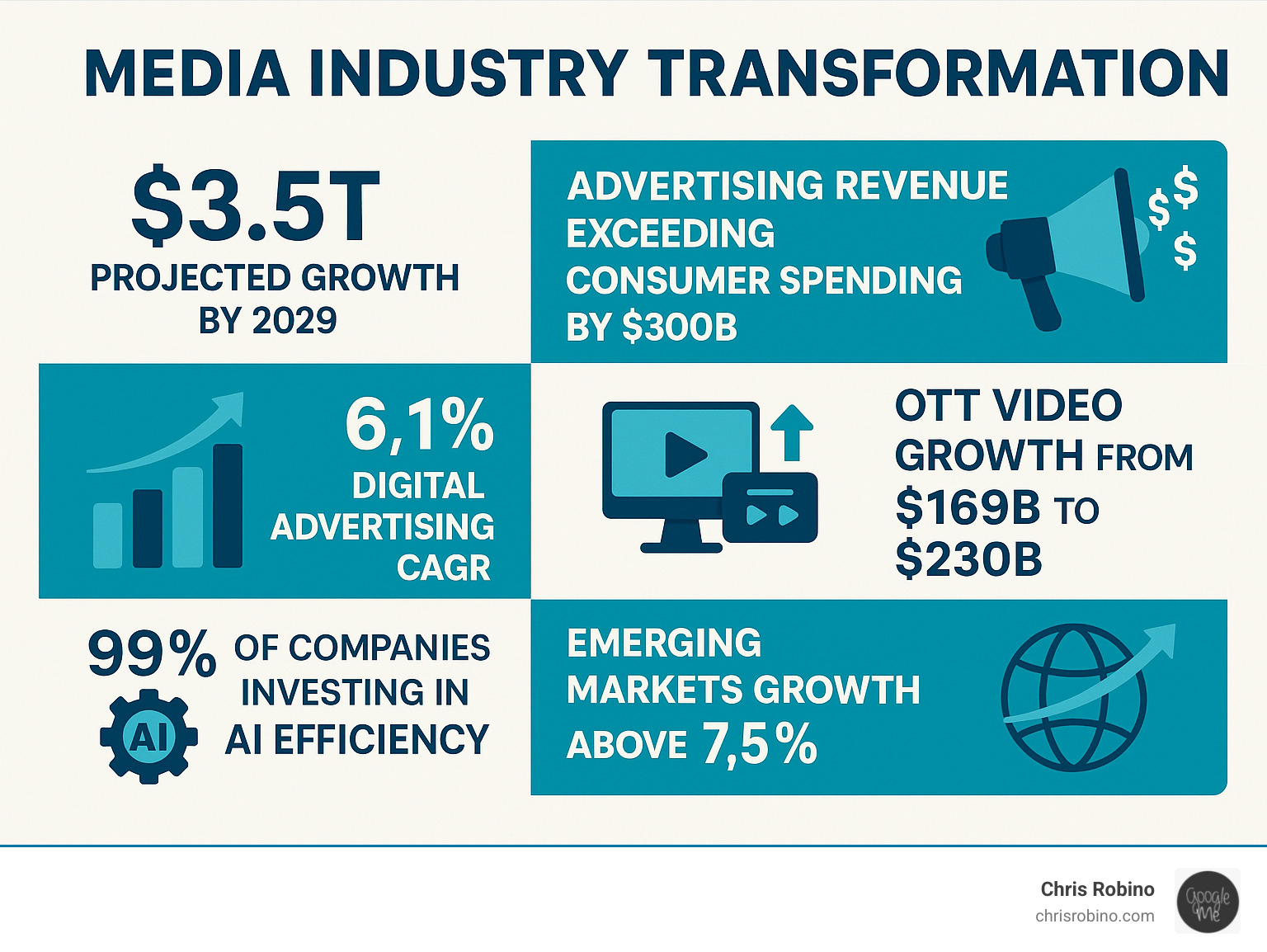

Media industry analysis reveals an industry in dramatic change, with global entertainment and media revenues projected to reach $3.5 trillion by 2029. This massive shift is driven by several key factors:

Key Market Drivers:

- Advertising Revenue Leadership – Set to generate $300 billion more than consumer spending by 2029.

- Digital Advertising Growth – A 6.1% CAGR far outpaces the 2.0% for consumer spending.

- Streaming Evolution – OTT video revenues are projected to grow from $169B to $230B by 2029.

- AI Integration – 99% of media companies are investing in AI for operational efficiency.

- Global Market Expansion – Emerging markets like India and Indonesia show growth rates over 7.5%.

The media landscape is being rewritten. Traditional revenue models are failing as streaming services chase profitability, linear TV faces structural decline, and AI reshapes everything from content to targeting. These changes are deeply interconnected, with social media, streaming, and gaming forming a single engagement ecosystem. Consumers, especially Gen Z, now demand personalized experiences that legacy media struggles to provide.

The financial pressure is immense: industry earnings have declined 18% annually over three years, despite flat revenues. This proves old strategies are no longer viable.

I’m Chris Robino, and for over two decades, I’ve guided organizations through digital change in the media sector. My work in media industry analysis and AI-driven business solutions shows that adaptation is the key to survival and success.

A Comprehensive Media Industry Analysis: Key Shifts and Challenges

Today’s media industry analysis shows an industry reinventing itself amidst a perfect storm of evolving revenue streams, changing customer behaviors, and technological disruption. Companies are scrambling to solve for streaming profitability, adopt AI, and boost operational efficiency in a fiercely competitive market.

The Evolving Revenue Landscape: From Subscriptions to Ads

The money game has changed. Predictable revenue streams are gone, replaced by advertising leadership. Ads are projected to generate $300 billion more than consumer spending by 2029, driven by digital advertising growth at a 6.1% CAGR, while consumer spending lags at 2.0%.

Streaming is at the center of this shift. OTT video revenue is set to jump from $169 billion to $230 billion by 2029. Ad-supported video-on-demand (AVOD) is a key driver, expected to account for 27.1% of total OTT revenues by 2029. Even major subscription services are embracing ads, with ad revenues projected to grow significantly. Revenue diversification is now a survival strategy, with companies boosting average revenue per user (ARPU) through retail media advertising and exploring new monetization models.

For companies looking to develop content that drives these new revenue streams, our Content Strategy Consulting approach helps create compelling content that converts.

Navigating New Consumer Expectations and Behaviors

Audiences now demand personalized experiences available on their terms. Generational media consumption habits, particularly those of Gen Z and Millennials, are reshaping the market. These digital natives prefer creator-led and user-generated content, fueling the impact on traditional media.

Cord-cutting continues to accelerate as consumers abandon cable for streaming. In response, the lines between entertainment, social media, and gaming are blurring, with social platforms becoming personalized content feeds. Understanding these behavioral shifts is essential for survival.

Companies that want to stay ahead need strategies built for this new reality. Our New Tech Media Strategies Guide helps organizations steer these complex changes.

A Strategic Media Industry Analysis of Technology’s Role

Technology, particularly AI in content creation and data integration, is driving industry change. A staggering 99% of companies are investing in these areas to improve operational efficiency. This isn’t just about cutting costs; it’s about freeing up resources for innovation.

AI-driven marketing is now the norm, accelerating content production and scaling personalized campaigns. From AI-generated backgrounds in animation to hyper-targeted ad campaigns, the applications are vast. Data integration is the engine that powers these AI tools, providing a complete view of audience behavior and content performance. This synergy enables companies to operate with unprecedented agility and precision.

For organizations ready to harness this power, our AI-Driven Business Solutions approach helps implement these technologies strategically. And our Cloud Solutions for Media provide the scalable infrastructure needed.

The Future of Media: Trends, Growth Markets, and Strategic Imperatives

Looking ahead, our media industry analysis reveals a landscape where innovation, opportunity, and harsh realities collide. The future will be defined by how companies adapt to new entertainment formats and find profitable ways to deliver them.

Key Trends Shaping the Future of Media

Experiential entertainment is a major trend, taking content beyond the screen into immersive, real-world events. For example, one major immersive venue generated $367 million in revenue from just 70 shows, proving audiences will pay a premium for unique experiences.

The global video game market continues its explosive growth, projected to hit nearly $300 billion by 2029. Exceeding music and movies combined, gaming has become a complete entertainment ecosystem, with phenomena like Japan’s VTubers building massive fan communities around content and merchandise.

Despite predictions of its demise, the global cinema box office is rebounding, projected to grow to $41.5 billion by 2029. Meanwhile, live sports content remains a critical driver for streaming engagement, though it creates a complex and expensive landscape for consumers. The growth of women’s sports and emerging leagues adds further opportunity.

For deeper insights into these shifts, check out our analysis of Current Trends in Entertainment.

Biggest Problems: Competition, Profitability, and Linear TV’s Decline

Despite growth, the industry faces sobering challenges. Industry leaders consistently cite increasing competition as their biggest hurdle. The battle for audience attention is fiercer than ever.

The streaming profitability puzzle also remains unsolved. After years of prioritizing growth, companies are now forced to focus on sustainable business models through price increases, bundling, and moderated content spending. Some are even exploring mergers to achieve the necessary scale.

Finally, linear television’s structural decline is an existential crisis. US media industry earnings have declined 18% annually for three years despite flat revenues, a clear sign that old models are broken. This perfect storm of streaming losses, a weak ad market, and linear decline has created significant uncertainty.

Our Media Industry Trends 2024 report provides detailed analysis of these obstacles.

A Forward-Looking Media Industry Analysis of Growth and Strategy

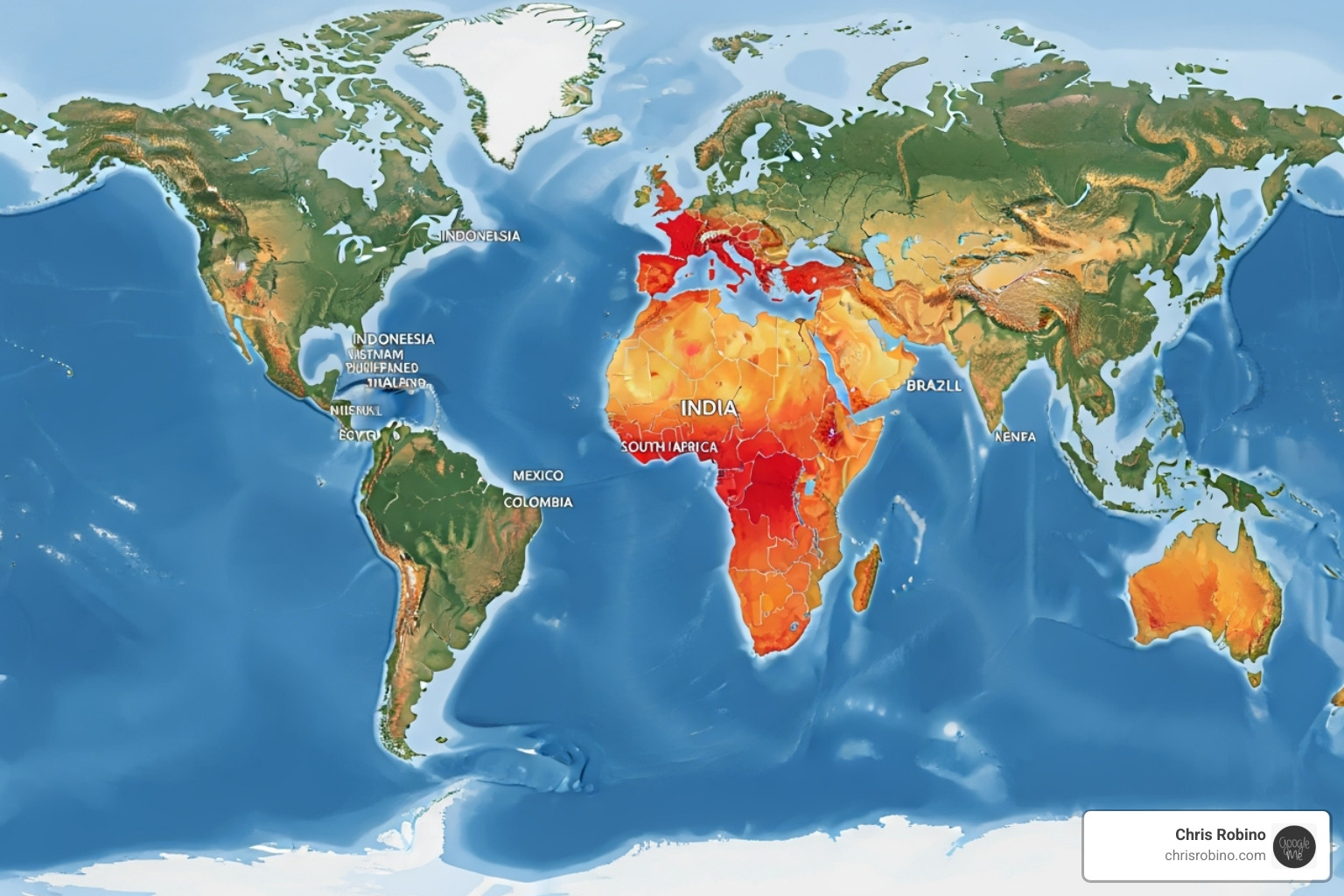

While mature markets are saturated, emerging markets offer tremendous growth potential. India, Indonesia, and Saudi Arabia are showing annual growth rates above 7.5%, attracting investment in localized content and business models.

Mergers, acquisitions, and strategic partnerships are also reshaping the industry at an unprecedented pace, with multi-billion dollar mega-deals aimed at building scale for future competition. The future belongs to companies that balance innovation with financial discipline and global reach with local relevance.

For organizations looking to steer this digital change, our expertise in Digital Change for Media provides the strategic guidance needed to thrive.

SEO Strategies for Large Media Companies

For large media companies, SEO is about staying relevant and building authority in a crowded digital space. A dynamic SEO strategy is crucial for competing against traditional outlets, social media creators, and streaming platforms. Here are key strategies that drive success:

-

Trend-Based Keyword Research: Go beyond basic keywords to track real-time search patterns around new shows, breaking news, and emerging genres. This ensures content aligns with immediate audience interest.

-

Content Clustering: Build authority by creating content ecosystems. A central pillar page on a broad topic (e.g., “streaming industry trends”) should be supported by and linked to more specific articles, strengthening your site’s topical relevance.

-

Technical Excellence: A flawless technical foundation is non-negotiable. Prioritize site speed, advanced mobile optimization for on-the-go consumption, and structured data to help search engines understand your content and generate rich snippets.

-

Multimedia Integration: Reflect modern consumption habits by embedding optimized video, podcast clips, and infographics within articles. This captures traffic from various media formats and improves engagement signals.

-

Strategic Internal Linking: Guide users and search engines through your vast content library. A thoughtful internal linking structure directs authority to your most important pages and demonstrates relationships between topics.

-

Localized and Global SEO: Adapt your strategy for different regions. Optimize for local search queries and cultural preferences to capture growth in both mature and emerging markets.

-

AI-Powered Optimization: Use AI tools to analyze massive datasets, identify content gaps, optimize headlines for higher click-through rates, and personalize content recommendations at scale.

-

Authoritative Backlink Building: Create original research, insightful media industry analysis, and thought leadership that industry professionals want to cite. This earns high-quality, organic backlinks that search engines value.

-

E-E-A-T and Algorithm Monitoring: Stay ahead of algorithm changes, with a special focus on major search engine guidelines for E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness), which are critical for establishing credibility in media.