Why the Media Production Trends of 2023 Still Matter

The media production industry trends of 2023 marked a pivotal year of dramatic highs and sobering corrections, fundamentally reshaping how content is made, funded, and distributed. Understanding this turning point is crucial for navigating the industry today.

Key 2023 Turning Points:

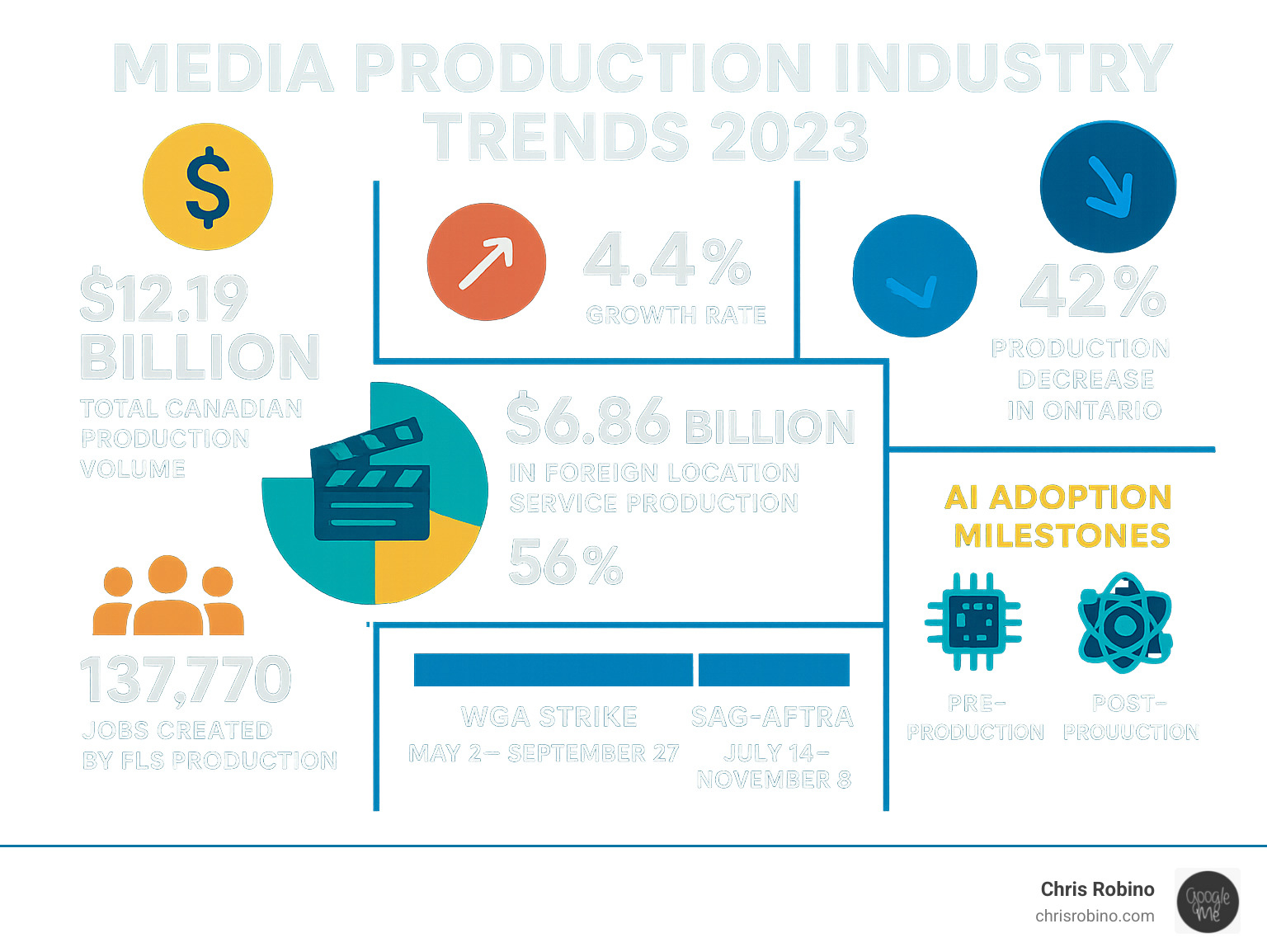

- Economic Whiplash: Canadian production hit a record $12.19 billion before major labor disruptions caused a sharp downturn.

- Labor Disruption: The WGA and SAG-AFTRA strikes halted global productions for months, forcing a strategic reset.

- AI Integration: Generative AI tools became integral to pre-production and post-production workflows.

- Streaming Evolution: The focus shifted from subscriber growth to profitability and ad-supported models.

- Industry Consolidation: Major M&A activity accelerated as companies sought cost savings and market power.

The year began with record production volumes but was upended by the dual Hollywood strikes. This standstill forced the industry to confront unsustainable growth and the role of AI in creative fields. The real story isn’t just the numbers—it’s the rapid shift from a quantity-focused model to one prioritizing sustainable business practices.

As Chris Robino, I’ve spent over two decades helping organizations steer digital change. My experience at the intersection of AI and media provides unique insight into how the foundational shifts of 2023 continue to shape production strategies moving forward.

The Economic Snapshot: A Look Back at 2022/23’s Record Highs and Hidden Fault Lines

To understand the current media landscape, we must look back at the calm before the storm. The 2022/23 fiscal year data for Canada’s screen-based sector painted a picture of record-breaking growth, just before a massive correction.

On paper, the numbers were stellar. Total production volume hit $12.19 billion, a 4.4% increase, with GDP contributions rising to $14.05 billion and supporting 239,380 Canadian jobs. However, a subtle 0.4% dip in employment hinted at rising production costs, a sign the industry was becoming more capital-intensive.

For a detailed breakdown, The complete Profile 2023 report offers the full picture. And to see how technology is reshaping the broader landscape, check out More info about the Tech Industry Report.

The Story of Two Halves: Investment and Content

Foreign investment was the main driver of this boom. Foreign Location and Service (FLS) production reached $6.86 billion, accounting for 56% of the entire Canadian market. This influx supported 137,770 jobs, making international productions a cornerstone of the Canadian economy. The streaming wars fueled this, with FLS TV series volume jumping 41.3% to $4.67 billion as major streaming platforms ramped up content.

Meanwhile, domestic production grew 6.5% to $4.14 billion, proving homegrown talent could thrive. This growth was led by English-language content, which surged 10.9%, while French-language production saw a decline. A shift in financing saw Canadian distributors increase their investment by a remarkable 39.7%, signaling growing confidence in local programming.

Geographically, Ontario ($4.35 billion), British Columbia ($3.75 billion), and Quebec ($3.11 billion) dominated the landscape. In contrast, Alberta’s FLS volume dropped sharply, a reminder of the sector’s volatility.

Why the Numbers Were Deceiving

The crucial context for these record figures is their timing. The report covered the fiscal year ending March 31, 2023—before the industry-altering WGA and SAG-AFTRA strikes began in May and July. The optimistic data from early 2023 quickly became an artifact of a bygone era.

The true impact was revealed in calendar year data: Ontario’s production dropped 42%, with foreign production crashing 55%. This disconnect between the official reports and the on-the-ground reality of late 2023 is essential to understanding the strategic shifts that define the industry today.

The Great Correction: How Labor Disputes and Shifting Strategies Reshaped the Landscape

If 2022/23 was the industry’s peak, then the rest of 2023 was its reality check. The media production industry trends of 2023 were fundamentally defined by two massive labor strikes that brought Hollywood and its global production network to a halt.

The Writers Guild of America (WGA) and Screen Actors Guild-American Federation of Television and Radio Artists (SAG-AFTRA) strikes were not just about contracts. They were a fight for economic survival in the streaming era, demanding fair compensation and protections against the perceived threat of AI replacing human creativity.

This labor dispute quickly became a global production crisis. The months-long strikes forced an industry-wide recalibration, shutting down productions and drying up content pipelines. Crucially, this happened just as the industry was already questioning its own growth-at-all-costs mentality, making the strikes a catalyst for a complete strategic reset. For deeper insights into how these disruptions continue to shape the industry, explore More info on Media Industry Trends 2024.

The Ripple Effect on Production Hubs

International production hubs like Canada learned a harsh lesson in dependency. The $6.86 billion FLS powerhouse virtually disappeared overnight. Crews, rental companies, and studios fell silent. The VFX industry was hit particularly hard as post-production work on existing projects was put on indefinite hold.

Ontario’s 42% production decrease in 2023 tells the story in stark numbers. When the strikes ended in late 2023, the expected flood of catch-up production was replaced by a more cautious, deliberate approach from studios that had used the pause to rethink their strategies.

A Strategic Pivot: From Content Volume to Value

The strikes accelerated a shift that was already underway: the end of “peak TV.” Streaming services realized that massive content spending did not guarantee profitability. Investor pressure forced a move away from chasing subscriber growth at any cost.

This led to “content spending rationalization,” where studios became more selective, focusing on the return on investment for each project. The new goal was subscriber retention over acquisition. Companies began investing in content that creates durable relationships with audiences, including targeted niche offerings that build loyal, long-term followings.

This pivot reshaped the industry from the ground up. A project’s value is no longer just about its creative merit but how it fits into a platform’s long-term strategy for retaining subscribers.

Global Media Production Industry Trends 2023: The Forces Shaping Tomorrow’s Content

The 2023 landscape wasn’t just shaped by strikes and economics. Powerful technological and strategic forces were changing how content is made, distributed, and consumed. These interconnected trends, from generative AI to streaming’s evolution, were accelerated by the year’s disruptions. For more on how companies are adapting, see More info on Innovation in Media Companies.

The AI Revolution: One of the most transformative media production industry trends 2023

Artificial Intelligence dominated industry conversations in 2023, moving from hype to practical application. In pre-production, AI tools began assisting with story concepts, dialogue generation, and storyboarding. In post-production, AI streamlined tedious tasks like object removal, color matching, and rotoscoping, freeing human artists for more creative work.

However, this integration came with conflict. The WGA and SAG-AFTRA strikes were fueled by concerns over AI’s role, from generating scripts to creating deepfake performances. These debates raised fundamental questions of copyright ownership and creator rights that the industry is still struggling with. A PwC report on AI’s economic impact projects it will contribute $15.7 trillion to the global economy by 2030, but the immediate story is about balancing cost savings with new creative possibilities and ethical considerations.

The Streaming Wars Enter a New Era

The era of aggressive expansion in streaming officially ended in 2023. The battle shifted from chasing subscriber numbers to achieving sustainable profitability.

Advertising-supported tiers became a key strategy, with major platforms finding many viewers willing to watch ads for a lower fee. This diversified revenue and is projected to account for 28% of global streaming revenues by 2028. The return of the bundle also re-emerged to reduce subscriber churn. Finally, password sharing crackdowns successfully converted many viewers into paying subscribers.

The new holy grail is subscriber retention. The high customer retention rates of leading services highlight why keeping existing customers is more valuable than constantly acquiring new ones.

| Model | Description | Revenue Source | 2023 Trends |

|---|---|---|---|

| SVOD | Subscription Video On Demand – monthly fees for ad-free content | Monthly subscription fees | Focus shifted from growth to retention; premium pricing maintained |

| AVOD | Advertising Video On Demand – free content supported by ads | Advertising revenue | Rapid growth as major platforms added ad-supported tiers |

| Hybrid | Combined subscription and advertising models | Both subscription fees and ads | Became the dominant strategy for major streaming services |

Consolidation and Convergence: A Look at key media production industry trends 2023

The push for profitability drove a wave of industry consolidation. Companies pursued mergers and acquisitions to eliminate redundancies and gain market power. The most fascinating trend was the convergence of gaming and media. With global video game revenues hitting $227.6 billion in 2023, gaming became central to entertainment strategy, with tools like real-time game engines used in film production and esports broadcasting drawing massive audiences.

Social media platforms evolved into major distribution channels, emphasizing short-form video and user-generated content. This, combined with AI-powered personalization, has transformed how audiences find and consume media, creating a more fragmented but highly customized entertainment landscape.

The Path Forward: Opportunities and Challenges on the Horizon

The media production industry trends of 2023 set the stage for a future built on the lessons learned from that year’s disruptions. The path forward is being shaped by regulatory changes, a commitment to sustainability, and the rise of creator-led media. For those tracking these developments, More info on Emerging Tech Insights offers deeper analysis.

Policy, Regulation, and the Push for Local Content

Governments are reshaping how streaming services operate within national borders. In Canada, Bill C-11 (the Online Streaming Act) is a pivotal move to ensure Canadian stories and creators receive support in the digital era. The CRTC framework requires global streamers to invest in Canadian content and ensure its findability. For domestic producers, this could open up significant new funding and create opportunities for local stories to reach global audiences on major platforms.

The Green Production Imperative

Sustainability is no longer just an ethical choice; it’s a business imperative. Producers are recognizing that sustainable production methods are economically smart. A 2023 Deloitte sustainability report found that a significant percentage of consumers favor brands committed to sustainability. More pressingly, climate change creates business continuity risks, with extreme weather disrupting filming and increasing costs. Reducing a production’s carbon footprint through innovations like AI-powered energy management and modular sets is becoming a practical necessity that also reduces operational expenditures.

The Rise of the Creator-Led Ecosystem

Media is becoming increasingly decentralized. The creator economy empowers individuals and small teams to produce, distribute, and monetize content without traditional gatekeepers. Through direct monetization on various platforms, creators can build and serve valuable niche audiences.

This presents both an opportunity and a challenge for traditional media. Companies can tap into fresh talent and innovative formats through brand partnerships. However, they also risk becoming irrelevant if they don’t adapt. The most successful companies will be those that support and amplify creators, building partnerships that provide creators with resources while giving established brands access to innovation and authenticity.

Frequently Asked Questions about Media Production Trends

As the media production industry trends of 2023 continue to influence the landscape, many professionals have questions about what these changes mean. Here are answers to the most common inquiries.

What is Foreign Location and Service (FLS) production?

FLS production is when foreign producers film in another country, like Canada, to leverage locations, skilled crews, and tax incentives. The foreign company retains ownership, while a local service producer manages the on-the-ground logistics. This became a massive economic driver for Canada, accounting for $6.86 billion in 2022/23 and supporting over 137,000 jobs. It’s a win-win, giving international studios access to world-class resources while boosting the local economy.

How is Generative AI expected to affect jobs in the media industry?

Generative AI is both a tool and a disruptor. It automates repetitive tasks in pre-production (e.g., concept art, script analysis) and post-production (e.g., VFX cleanup, basic editing), which can displace some roles. However, it also amplifies human creativity and creates new jobs, such as AI pipeline managers and prompt engineers. Professionals who learn to leverage AI as a powerful assistant will thrive, focusing on higher-value creative work while AI handles routine tasks. The goal is to augment human talent, not replace it.

Will streaming services become cheaper as they add advertising?

You will have more choices on how to pay. Services are not necessarily getting cheaper overall, but they are offering lower-priced ad-supported tiers to appeal to budget-conscious viewers. This gives consumers the option to pay with their attention instead of just their wallet. The premium, ad-free tiers will likely remain at similar or even higher price points. This hybrid approach allows streamers to diversify revenue with both subscriptions and ads, creating a more sustainable business model.

Conclusion

The media production industry trends of 2023 tell a story of profound and lasting change. It was a year that forced a complete reimagining of how content is made, funded, and consumed globally.

We witnessed a dramatic arc: from record-breaking production volumes to a complete standstill caused by the Hollywood strikes. That pause forced the industry to confront critical questions about sustainability, labor, and the role of AI. What emerged is a more thoughtful industry, focused on building durable subscriber relationships rather than just chasing growth. Streaming services acceptd hybrid models, and AI tools became standard, sparking ongoing debates about their place in the creative process.

These shifts are all interconnected. The labor disputes amplified AI concerns, investor demands for profitability ended the “peak TV” arms race, and the push for sustainability became a business necessity.

For today’s producers and creators, agility is paramount. Success now requires understanding how technology can augment human creativity, building authentic audience relationships, and integrating ethical and sustainable practices into core business strategy. The Canadian industry is well-positioned for this new era, but staying competitive means embracing these interconnected trends.

The companies that thrive will be those that see these challenges as opportunities for innovation. The disruptions of 2023 were not just destructive; they paved the way for a more sustainable, equitable, and creative industry. The key is to remember that at the heart of all this technology and strategy, we are still telling stories that matter.

For expert insights on navigating the intersection of media and technology, explore these reasonable tech questions and answers.