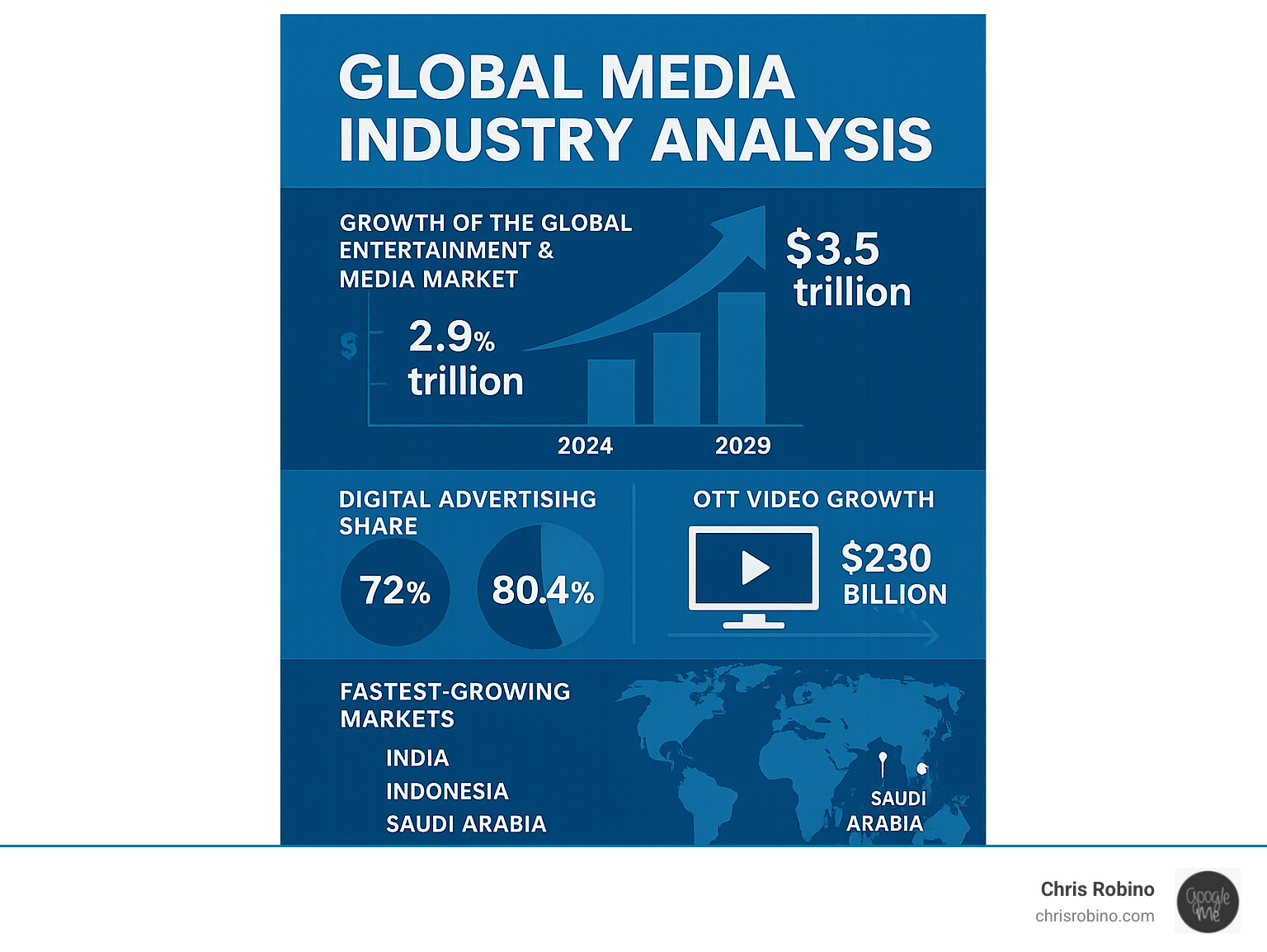

The Shifting Tides of a $3.5 Trillion Industry

Global media industry analysis reveals an industry in rapid change. Revenues are projected to grow from $2.9 trillion in 2024 to $3.5 trillion by 2029, a 3.7% CAGR driven by digital advertising, the evolution of streaming, and AI integration. This shift is fundamentally reshaping how content is created, consumed, and monetized worldwide.

The economic balance is tipping decisively toward advertising, which is set to generate $300 billion more than consumer spending by 2029. Digital formats are at the heart of this change, expected to account for over 80% of ad revenue by 2029. This digital dominance is mirrored in consumer behavior: traditional TV subscriptions continue to decline, with only 49% of consumers maintaining cable, down from 63% three years ago. Meanwhile, 56% of Gen Z now finds social media content more relevant than traditional TV and movies.

This change is not just about cord-cutting; it’s about new ecosystems for content findy and payment. Key growth sectors include OTT video, expanding to $230 billion, and the video game market, which is projected to reach nearly $300 billion by 2029. Regional dynamics, with high-growth markets like India and China, add another layer of complexity to this global shift.

I’m Chris Robino. With over two decades of experience driving digital change for media companies, I’ve seen how AI and intelligent automation are redefining the industry. My work helps organizations steer these complex shifts, providing a clear perspective on where this $3.5 trillion industry is headed.

A Comprehensive Global Media Industry Analysis for 2025 and Beyond

The media landscape isn’t just changing—it’s being completely rewritten. Our global media industry analysis shows an industry racing toward a $3.5 trillion future, powered by forces that would have seemed impossible just a decade ago.

The New Power Players: Advertising, Streaming, and Gaming

The economic foundations of media are being reshaped by three dominant forces.

Advertising is now the primary revenue driver. By 2029, advertising will generate $300 billion more than consumer spending, growing at 6.1% compared to just 2.0% for the consumer segment. This is fueled by the digital revolution, with digital formats projected to capture 80.4% of all ad revenue by 2029, a trend that continues to rise at an impressive pace.

Streaming services are seeing explosive growth, with Over-the-Top (OTT) video revenues climbing from $169 billion to $230 billion by 2029. Notably, ad-supported video-on-demand (AVOD) is gaining significant traction and is expected to account for 27.1% of total OTT revenues. This reflects a consumer preference for lower costs, as the average monthly cable bill of $125 far exceeds the ~$69 cost for a bundle of four streaming services. While digital surges, traditional formats like cinema are still relevant, with box office revenues projected to grow to $41.5 billion by 2029.

Gaming has emerged as a media giant, with its market set to reach nearly $300 billion by 2029, generating more revenue than music and movies combined. Advertising is also changing gaming economics, with its share of revenue projected to grow from 32.3% in 2024 to 38.5% by 2029. This signifies a fundamental shift in how games are monetized.

For deeper insights into where media production is heading, check out our analysis of Media Industry Trends 2025.

Decoding Modern Consumption: The On-Demand, Social, and Niche Revolution

Consumer behavior is undergoing a dramatic change, driven by new expectations for how content is delivered and consumed.

Cord-cutting has accelerated, with only 49% of consumers now holding cable or satellite subscriptions, a sharp decline from 63% three years ago. The value proposition is clear when comparing a $125 monthly cable bill to about $69 for four streaming services. However, the streaming market faces its own challenges, including content satisfaction and price sensitivity. With 41% of subscribers feeling SVOD content isn’t worth the price, and 39% canceling a service in the last six months, the pressure is on. This is pushing consumers toward AVOD, with 54% of SVOD subscribers now using at least one ad-supported service.

Younger generations are leading a content revolution. A crucial statistic reveals this shift: 56% of Gen Z and 43% of millennials find social media content more relevant than traditional TV shows and movies. Social platforms are now primary content hubs that influence purchasing decisions, creating a new ecosystem where creators compete directly with media companies for attention and ad dollars. This means traditional media must now contend with an endless stream of user-generated, personalized content that feels more authentic to younger audiences.

Our Content Strategy Consulting work helps organizations steer these shifts by bridging traditional and social media approaches.

Here’s how the video entertainment landscape breaks down:

| Feature | Traditional Cable/Satellite TV | Ad-Free SVOD | Ad-Supported SVOD (AVOD) |

|---|---|---|---|

| Average Monthly Cost | ~$125 | ~$17.25 (for 4 services) | Varies, but lower than ad-free |

| Content Model | Linear, scheduled | On-demand, subscription | On-demand, ad-supported |

| Content Relevance (Gen Z/Millennials) | Lower (often) | Moderate | Higher (often, due to niche/personalized content) |

| Flexibility | Low | High | High |

| Current Adoption | 49% (declining) | High | 54% of SVOD subscribers |

| Primary Revenue | Subscriptions, ads | Subscriptions | Advertising |

The Tech Catalyst: How AI and Mixed Reality Are Reshaping Media

Technology is no longer just supporting the media industry; it’s actively reshaping it. Artificial Intelligence and Mixed Reality are evolving from experimental tools into essential business infrastructure.

AI is changing content creation and advertising. With over $56 billion invested in generative AI businesses in 2024, the technology is dramatically shortening development cycles in areas like video game design. Beyond creation, AI is revolutionizing advertising with hyper-targeted campaigns powered by advanced analytics. The search landscape is also changing as AI-powered engines alter how people find information, meaning traditional SEO will need to be redefined for new AI-driven behaviors. While AI’s rapid advancement raises valid concerns about copyright and job displacement, its potential to open up new business models is undeniable.

Mixed Reality is moving from hype to practical application. The US mobile AR market alone generated $12.7 billion in 2024. While a fully realized metaverse is still on the horizon, AR and VR are already creating immersive experiences, from virtual concerts to interactive storytelling that blurs the line between physical and digital worlds.

For guidance on integrating AI into your content strategy, explore our AI-Driven Content Strategy insights. If you’re looking to implement cutting-edge technologies, our Emerging Technology Consultant expertise can help.

A Tale of Many Markets: Regional Dynamics and Regulatory Landscapes

Global media industry analysis must account for diverse regional ecosystems, where market conditions and regulations create unique opportunities and challenges.

- The US remains the largest media market at $649 billion, projected to reach $808 billion by 2028 with steady 3.8% CAGR. It combines mature infrastructure with constant innovation.

- China showcases digital dominance, with 6.1% CAGR in media revenues and an impressive 8.9% CAGR in internet advertising. Its unique regulatory environment has spurred new content formats like short-form ‘micro-dramas’.

- India represents explosive growth, with media revenues growing above 7.5% CAGR and internet advertising at a staggering 15.9% CAGR. Its creator economy is booming, with over 50 OTT platforms competing for audiences.

- Emerging markets like Indonesia and Saudi Arabia are also posting growth rates above 7.5%, driven by rising internet penetration and demand for local content.

Navigating different regulatory landscapes—from European content quotas to US antitrust concerns—is crucial. Success requires flexible strategies that adapt to diverse cultural and regulatory contexts.

Our Cloud Solutions for Media insights help companies build the infrastructure needed to succeed across these varied regions.

Strategic Imperatives: Navigating the Future of Media

The insights from our global media industry analysis reveal an industry at a critical turning point. Success in this environment demands more than incremental improvements; it requires bold strategic thinking and decisive action.

The Evolving Competitive Landscape: M&A and Strategic Alliances

The media industry is undergoing a wave of consolidation and partnerships that are reshaping competitive dynamics. Mega-deals, such as the acquisition of major studios, highlight a broader trend: consolidation is now a survival strategy. Companies are merging to combine creative capabilities with data, giving them the scale to compete with tech giants, gain negotiating power, and weather economic shifts.

Strategic partnerships are equally critical for sharing risks and expanding reach. Collaborations, like those between Latin American and US studios, allow companies to leverage local expertise while managing the high costs of content creation and market entry. The pressure is immense, with skyrocketing sports media rights and fragmented IP licensing.

Traditional media companies face the dual challenge of competing with each other and with social platforms that operate on different economic models. The most effective response has been a focus on disciplined monetization, hybrid revenue models, and strategic restructuring. The winners will be those who control valuable IP while building agility through smart partnerships.

Our Digital Strategy Advice helps organizations identify and execute these critical alliance opportunities.

Charting Your Course: Key Takeaways from Our Global Media Industry Analysis

Our global media industry analysis points to several clear strategic imperatives for any media company aiming to thrive.

- Agility is the ultimate advantage. With 39% of consumers canceling streaming services every six months, the ability to pivot quickly on content, pricing, and user experience is essential for survival.

- Revenue model innovation is mandatory. The old binary choice between subscriptions and advertising is obsolete. The future belongs to hybrid approaches, as proven by AVOD’s projected growth to 27.1% of total OTT revenues by 2029.

- Digital-first thinking must guide all decisions. When 56% of Gen Z prefers social media content, digital cannot be a silo. It must be the foundation of content strategy, audience engagement, and revenue planning.

- Authentic audience relationships are the new currency. Success now comes from building communities. Understanding that 63% of Gen Z’s purchasing decisions are influenced by social media requires a content process built on fostering genuine connections.

- Technology integration must be strategic. The $56 billion invested in generative AI in 2024 wasn’t for novelty; it was to compress development cycles and enable personalization at scale. Adopt tech that solves real business problems.

The path forward requires bold moves. Companies that will dominate the next decade are those restructuring revenue models, forming strategic partnerships, and reimagining content creation and distribution today.

At ChrisRobino.com, I’ve spent over two decades helping media companies steer these transformative moments. My work in Digital Change for Media focuses on turning industry insights into actionable strategies that drive real results. The global media industry analysis shows us where the industry is heading—the question is whether your organization is ready to get there first.