The Modern Media Landscape: An Introduction

The media and entertainment industry overview reveals a dynamic $703 billion U.S. market that’s fundamentally reshaping how we consume content. This industry encompasses everything from streaming services and video games to social media platforms and traditional broadcast—all creating, producing, and distributing the content that fills our daily lives.

Here’s what defines the modern media and entertainment landscape:

- Market Scale: The U.S. represents 33% of the global M&E market, making it the world’s largest

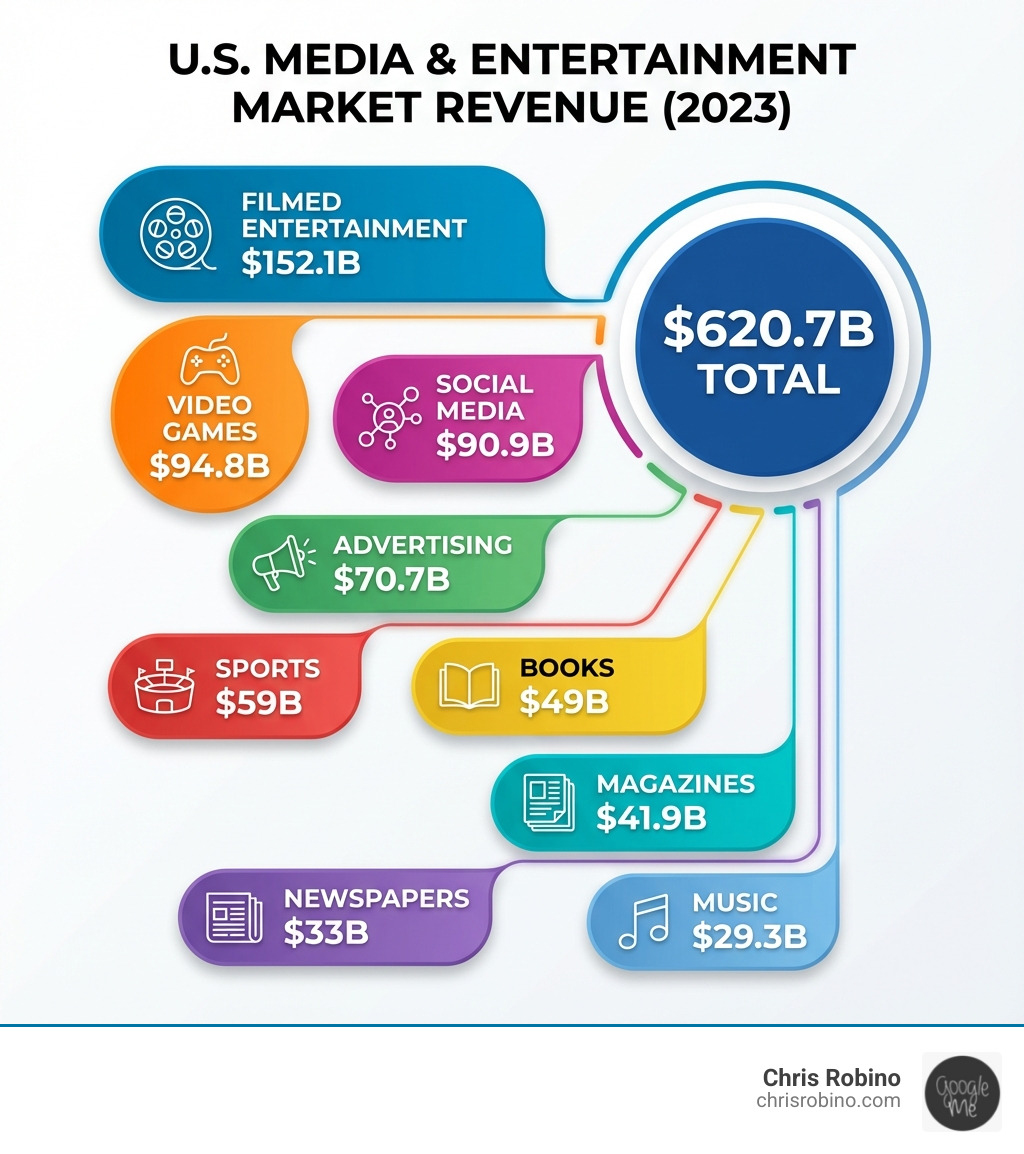

- Core Sectors: Filmed entertainment ($152.1B), video games ($94.8B), social media ($90.9B), advertising ($70.7B), and sports ($59B)

- Digital Dominance: Digital media spending ($320B in 2023) officially surpassed traditional media for the first time in 2021

- Growth Trajectory: Industry revenues reached $620.7B in 2023, projected to hit $677B by 2025

- Employment: Nearly 2 million jobs across production, distribution, and technology roles

The industry demonstrated remarkable resilience through the pandemic. While experiencing a -3% contraction in 2020, it bounced back with 10.4% growth in 2021 and has maintained steady expansion since. Digital-first sectors like social media (growing 13.4% annually) and OTT streaming (growing 25.2% annually) drove this recovery.

Traditional media faces headwinds. Cable TV subscriptions continue declining, theatrical releases struggle to return to pre-pandemic levels, and print media revenues shrink year over year. Meanwhile, consumer spending patterns shifted dramatically—digital media now captures 57% of all consumer and advertising spend, up from 39% in 2019.

I’m Chris Robino, and I’ve spent over two decades helping organizations steer digital change in the media and entertainment industry overview space, from emerging streaming platforms to established broadcast networks. My work focuses on leveraging AI-driven strategies to maximize ROI in this rapidly evolving landscape.

Media and entertainment industry overview vocab to learn:

- emerging trends in entertainment and media industry

- media industry trends 2024

- media production industry trends 2025

The Current State and Future of the Media and Entertainment Industry Overview

The media and entertainment industry overview is a vibrant ecosystem constantly evolving. From box office hits to viral videos, this sector shapes culture and commerce alike. Let’s explore its current state and what the future holds.

Understanding the Media and Entertainment Industry Overview: Market Size & Growth

The U.S. media and entertainment industry overview is a true titan, representing a significant portion of the global market. In 2023, our industry revenues reached an impressive $620.7 billion, marking a healthy 2.1% year-over-year increase. The trajectory continues upward, with projections of $648 billion by the end of 2024 and an estimated $677 billion by 2025. This consistent growth, averaging +2.3% annually from 2019 to 2023, even outpaced the U.S. GDP growth of +2% over the same period. We are truly in a growth industry!

Within this vast landscape, certain sectors shine brighter than others. Filmed entertainment, encompassing all video content for film, TV, and digital distribution, remains a powerhouse. It generated $152.1 billion in revenue in 2023, making it the largest sector by a considerable margin. Following closely, video games brought in $94.8 billion in 2023, demonstrating a steady, albeit modest, annual growth rate of +0.8%.

However, the real showstopper in terms of growth is social media. This sector dominated the industry landscape, capturing an average double-digit revenue growth rate of +13.4% per year from 2019 to 2023, ultimately reaching $90.9 billion in 2023. The shift towards digital consumption is undeniable, with sales of over-the-top (OTT) video content growing at an average of 25.2% annually from 2019 to 2023. This remarkable resilience and growth, particularly in digital-first areas, highlight the industry’s dynamic nature. For a deeper look into the global landscape, consider our global media industry analysis.

Key Trends Shaping the Future of Media and Entertainment

The media and entertainment industry overview is constantly being reshaped by powerful forces. At the forefront is the relentless march of digital change. We’ve seen digital media spending officially surpass traditional media spending for the first time in 2021, and this trend continues, with digital expected to account for 68% of total consumer and advertising spend by 2028.

Changing consumer expectations are a massive driver. Today’s audiences don’t just want content; they demand highly custom, personalized experiences. This push for personalization influences everything from streaming recommendations to interactive gaming environments.

Artificial intelligence (AI) is rapidly moving from a futuristic concept to a practical tool. Its role in content creation is expanding, as seen with major streaming services piloting AI-assisted dubbing for movies and series. Generative AI, in particular, is ready to fundamentally change content creation, distribution, and consumption, offering new avenues for efficiency and creativity. However, it’s not without its skeptics, especially in the gaming industry, where some developers express concerns about AI’s impact.

Emerging content formats and platforms are continuously gaining traction. Short-form video, popularized by leading social media platforms, continues its explosive growth. In markets like China, we’re even seeing the rise of “micro-dramas” – minute-long, vertically shot episodes designed for quick consumption. Esports, already a significant player with $275 million in revenue in the U.S. and $318 million in Asia in 2017, continues its impressive 22.6% growth rate, drawing massive audiences and advertising dollars.

You can explore more about emerging trends in entertainment and media industry on our site.

Revenue Models, Advertising, and Monetization Strategies

Understanding the diverse ways media and entertainment industry overview companies generate revenue is key to grasping their strategies. While advertising remains a dominant revenue stream, especially with global advertising forecast to rise 9.5% in 2024, diversification is crucial for sustainability and growth.

We see a significant shift in how content is monetized:

- Subscription Models (SVOD): Premium SVOD subscribers were up 10.4% in 2024, and global streaming subscriptions are set to reach 2 billion by 2029. Global SVOD revenue is projected to surge by $116.6 billion over the next eight years, showing consumers’ willingness to pay for exclusive access.

- Ad-Supported Models (AVOD): The growth of ad-supported video on demand (AVOD) is phenomenal, expanding by an average of 27.8% annually from 2019 to 2025. This reflects a growing acceptance of ads in exchange for free or lower-cost content. Digital video ad spend is now growing nearly 80% faster than media overall, highlighting the power of this model. Even major cable and internet providers see an opportunity in SMB streaming advertising, recognizing the vast potential.

- Transactional Models (TVOD): While smaller, transactional video on demand (TVOD) also saw growth, increasing by 3.7% annually from 2019 to 2025, indicating that consumers are still willing to pay per-view for specific content.

The advertising landscape itself is evolving rapidly. We anticipate CPMs (cost per mille) to fall again at the 2025 Upfronts, indicating a dynamic market where efficiency and targeting are paramount. Social Ad CPMs are also subject to ongoing forecasts, reflecting the immense spending in this area. Interestingly, major tech platforms benefit significantly from AI-created ads, showcasing how technology is streamlining and enhancing advertising efforts. For more on how companies are monetizing digital content, check out our insights on digital content monetization.

Global Market Dynamics and Regional Consumer Behavior

The global media and entertainment industry overview is a patchwork of diverse markets, each with its own unique dynamics and consumer behaviors. While the U.S. remains the largest market, accounting for 33% of the global industry, other regions are experiencing rapid and distinct changes.

- U.S. Market Leadership: Our market’s sheer size and its blend of traditional and digital powerhouses continue to set global trends, particularly in streaming, gaming, and social media innovation.

- India’s Diverse OTT Market: India stands out with a thriving industry of more than 50 OTT subscription platforms. This highly fragmented market often streams content in regional languages, catering to a vast and linguistically diverse audience. This fragmentation suggests it’s ripe for consolidation, as evidenced by recent market consolidations.

- China’s Growth in Digital Content: China is a hotbed for digital content innovation, particularly with the booming demand for short-form “micro-dramas” on popular social media platforms. These minute-long, vertically shot episodes are gaining immense popularity, partly due to affordability pressures on subscriptions and their seamless integration with e-commerce.

- Brazil’s Internationalization and Ad-Funded Strategies: In Brazil, we observe a dual strategy of internationalization and the adoption of free ad-funded services to capture OTT value. One major streaming arm of a local media conglomerate, for example, is actively expanding its reach across Latin America and the U.S., even collaborating with major U.S.-based studios. Similarly, the launch of ad-supported streaming platforms by local broadcasters illustrates the market’s adaptation to consumer demand for accessible content.

These regional differences underscore the need for a nuanced approach to global strategies. A deeper dive into these market specifics can be found in our comprehensive media industry analysis.

Challenges and Strategic Priorities for Industry Leaders

Navigating the complex media and entertainment industry overview is not without its problems. Industry leaders consistently identify increasing competition as their primary challenge. With a proliferation of content, platforms, and creators, standing out and retaining audience attention is tougher than ever.

Customer churn is another significant concern. Audiences have more choices and lower switching costs, making loyalty a fleeting commodity. This drives the imperative for companies to diversify revenue streams beyond traditional advertising and to focus relentlessly on delivering differentiated content and exceptional customer experiences.

Economic headwinds, such as inflation and potential recessions, also cast a shadow, impacting advertising budgets and consumer discretionary spending. Advertising spend, for instance, was forecasted to decrease in the near term in some analyses, adding pressure to revenue models.

Adapting to digital shifts is not just a trend; it’s a survival mechanism. Traditional media sectors, including print and broadcast, are struggling with declining audiences and revenues. The DVD business, once a cornerstone, officially died last year. Cable TV subscriptions are declining at an alarming rate of -5% annually, with some streaming TV services even forecasted to become the largest pay-TV distributors by 2026. Newspapers and magazines continue to see declining spending, forcing them to innovate or fade.

These challenges necessitate a strong focus on strategic priorities:

- Operational Efficiency: 99% of media and entertainment companies are investing in operational efficiency, leveraging technology to streamline processes.

- Personalized Experiences: Crafting highly custom content and customer journeys is crucial for retaining and attracting audiences.

- Audience Engagement: Developing robust audience engagement strategies is paramount to building loyalty in a saturated market.

Navigating the Future: Technology, Investment, and Strategy

The media and entertainment industry overview is fundamentally a technology-driven sector. Our ability to innovate and strategically invest in emerging technologies will define the next era.

Technology and Investment: A Media and Entertainment Industry Overview

The technological landscape is rapidly evolving, with several key areas changing the media and entertainment industry overview:

- Artificial Intelligence (AI): AI is being leveraged for operational efficiency across the board, with 99% of companies investing in it. From AI-assisted dubbing in filmmaking to optimizing ad placements and personalizing content recommendations, AI is becoming indispensable.

- Automation: Alongside AI, automation is streamlining workflows, reducing manual tasks, and improving speed from content creation to distribution.

- Cloud Solutions: Cloud-based infrastructure offers scalability, flexibility, and cost-effectiveness for storage, processing, and delivery of vast amounts of media content.

- Virtual and Augmented Reality (VR/AR): While growth is expected to pause for AR/VR headsets in the near term, these immersive technologies hold immense potential for gaming, live events, and interactive storytelling.

Generative AI, in particular, is a game-changer. It impacts content creation by enabling rapid prototyping, script generation, and even synthetic media. Its influence extends to distribution, allowing for dynamic localization and personalized delivery, and to consumption, with AI-powered findy and interactive experiences. The increasing affordability of large language models makes these tools more accessible than ever.

Key investment trends reflect this technological shift. Gaming M&A (mergers and acquisitions) returned to growth in 2024, signaling confidence in the sector despite some internal skepticism about AI’s immediate impact on game development. Broader industry M&A activity is also noteworthy, such as major retailers acquiring smart TV manufacturers, indicating strategic moves to control content distribution and consumer touchpoints.

Government incentives and tax credits play a crucial role in fostering growth in specific segments. Metro Vancouver, for example, has become North America’s fastest-growing Digital Media & Entertainment hub, thanks in part to competitive tax credits for film, TV, and interactive digital media production. These incentives can significantly influence where content is produced and developed.

The future outlook for our industry is one of steady growth and continuous innovation. As outlined in recent industry action plans, strategic planning and agile adaptation are key.

In this complex and rapidly changing market, expert guidance is invaluable. Professionals like Chris Robino help organizations steer these changes, leveraging deep industry knowledge and technological acumen to ensure success. We’re here to help you explore more reasonable tech questions and answers and make informed decisions for your media and entertainment ventures.