Navigating the $3.5 Trillion Media Maze

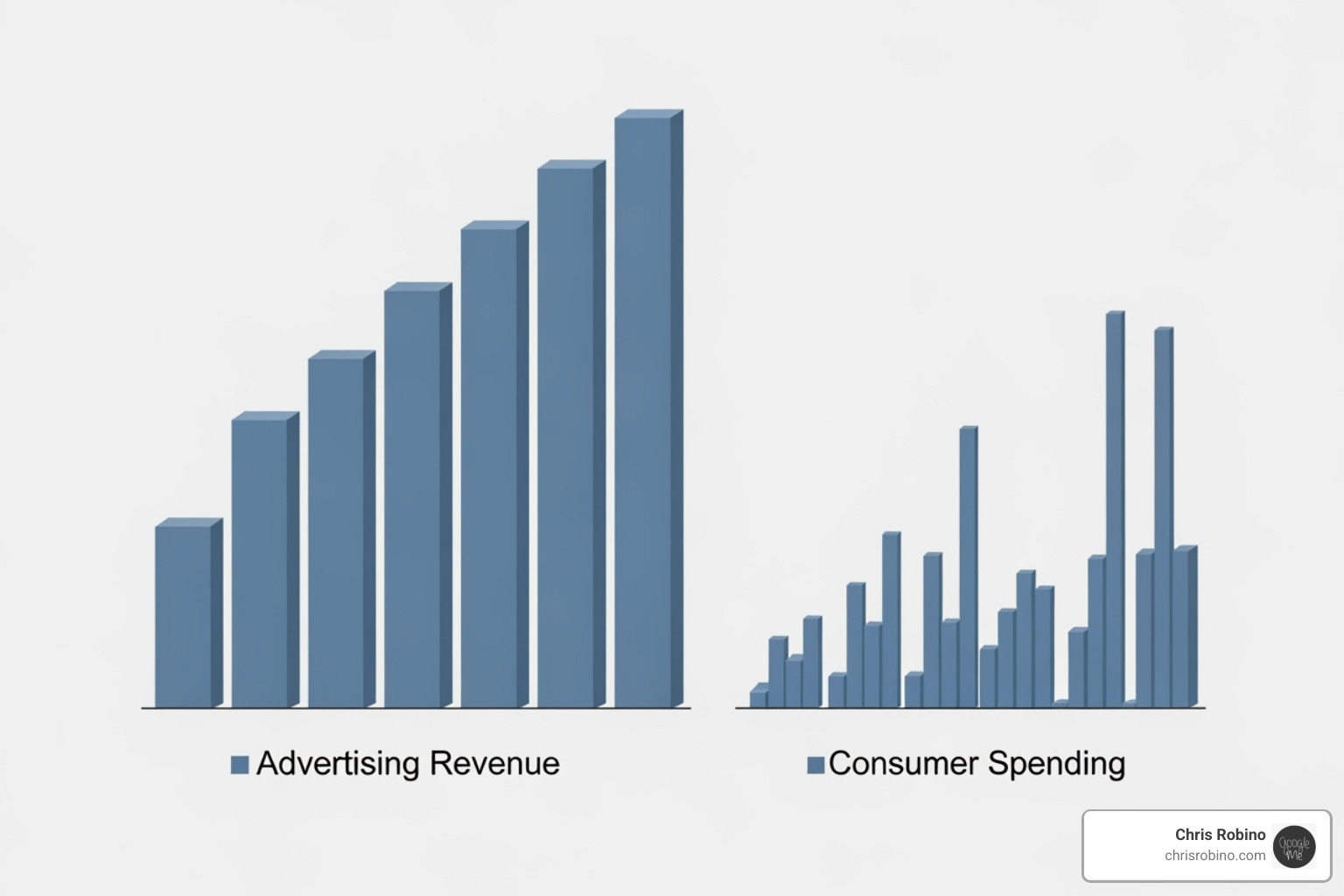

Media industry report data reveals a massive shift happening right now. The global entertainment and media industry is racing toward $3.5 trillion by 2029, but the path there is anything but simple. The numbers tell a compelling story: for the first time, advertising revenue now exceeds consumer spending, growing at 6.1% annually while consumer spending crawls at just 2.0%.

This growth is overwhelmingly digital, with online formats projected to capture 80.4% of ad revenue by 2029. But traditional metrics are breaking down. Cable subscriptions have plummeted, and 56% of Gen Z now finds social media content more relevant than TV shows and movies. Meanwhile, the fastest-growing markets are not in North America or Europe, but in India, Indonesia, and Saudi Arabia, all posting growth rates above 7.5%.

AI is another powerful force, reshaping everything from content creation to audience targeting. I’m Chris Robino, and I’ve spent over two decades helping companies steer digital change and leverage media industry report insights for strategic growth. My work focuses on turning complex industry data into actionable business strategies that drive measurable results.

For large companies, these shifts demand an enterprise-grade search strategy. The practical takeaway: use media-industry data to plan high-intent content at scale, structure sites for findability, and align SEO with paid and partner channels to compound returns. If youre optimizing at scale, anchor your roadmap in search engine optimization fundamentalstechnical performance, authoritative content, and measurable outcomes.

Key Shifts Revealed in the Latest Media Industry Report Data

The media world is undergoing its biggest shake-up in decades. Analysis of media industry report data shows the global entertainment and media industry racing toward $3.5 trillion by 2029, but this isn’t a simple growth story. We’re seeing fundamental shifts that are rewriting the rules of monetization. For the first time, global advertising revenue has overtaken consumer spending, with ad revenue growing at 6.1% annually compared to just 2.0% for consumer spending.

This new revenue is flowing to different places. Digital formats will control 80.4% of ad revenue by 2029, while generational preferences are accelerating the change. With 56% of Gen Z finding social media more relevant than traditional TV, attention and ad dollars are moving fast. Geography also matters, as emerging markets like India, Indonesia, and Saudi Arabia are growing at over 7.5% annually. These shifts create massive opportunities for companies that adapt quicklyespecially those that can translate trend data into enterprise SEO programs that scale across markets, devices, and content formats.

Want to dive deeper into these patterns? Check out our comprehensive analysis in Media Industry Trends 2024.

The Advertising Gold Rush: Digital, Retail, and CTV

An advertising gold rush is underway, concentrated in three key areas: digital formats, retail media, and Connected TV (CTV). Digital advertising is dominant, climbing to 80.4% of all ad revenue by 2029 due to its precision targeting and measurable ROI.

Within digital, retail media platforms are becoming powerhouses, set to control 45.5% of paid-search revenue by 2029. They capture consumers at the moment of purchase with highly relevant, data-driven ads.

CTV bridges the gap between traditional and digital, with its ad revenue share projected to hit 44.7% of broadcast TV advertising by 2029. It offers the big-screen experience of TV with the data-driven precision of digital, making it prime real estate as cord-cutting continues. Understanding these three pillars is crucial for capitalizing on the advertising boom. For strategic guidance on leveraging these trends, explore our Digital Marketing Strategy Advice.

Enterprise SEO implications for large companies:

- Retail media and marketplace SEO are converging. Build authoritative product content and structured data (Product, Review, AggregateRating) to win visibility both on marketplaces and across the open web. Reinforce category hubs with internal links and expert content to rank for high-intent queries while improving conversion on platform listings. For background on the ad channel context, see Retail media.

- Expect CTV to drive second-screen search surges. Align CTV flights with branded and non-brand search capture (landing pages, FAQs, and how-to content that match the spots message). Use log-file analysis and MMM to quantify how CTV uplifts organic search. Learn more about the channels dynamics via Connected television.

- Orchestrate SEO with paid. Use shared taxonomies, query clustering, and creative messaging across paid search, retail media, and organic to improve Quality Score equivalents, reduce CPA, and compound total SERP share.

Streaming’s Next Chapter: AVOD, Audience Fatigue, and Social Video

The streaming story is getting complicated. While the market is still growing, 41% of consumers now feel their subscriptions aren’t worth the price. This audience fatigue is driving the ad-supported video on demand (AVOD) revolution, with AVOD projected to account for 27.1% of total streaming revenues by 2029.

Younger audiences are leading the charge, with over two-thirds of Gen Z and millennials using free ad-supported services. This trend is amplified by relentless cord-cutting, as only 49% of consumers still have cable TV.

However, the biggest disruptor may be social media. With 56% of Gen Z finding social content more relevant than TV and movies, platforms that feature short-form, interactive video are redefining entertainment. Success in streaming now requires a flexible strategy that accepts subscription, advertising, and hybrid models. If you need help navigating video strategy, explore our Video Marketing Consultant services.

Enterprise SEO implications for large companies:

- Treat video SEO as a first-class channel. Use descriptive titles, transcripts, and chaptering, and add appropriate structured data (for example, VideoObject) to open up rich results and key moments. Map videos to content hubs that target recurring audience questions about shows, genres, pricing, and value.

- Capture findy queries driven by AVOD and F.A.S.T. Distribute owned video to where searchers are, and build pages that rank for where to watch, free episode, and show + platformqueries. For context, see Free ad-supported streaming television.

- Optimize for social search. Repurpose short-form clips with captions and semantically rich descriptions that align with trending queries. Tie social video calendars to SEO topics and always link back to authoritative hub content.

The AI and Gaming Revolution

The future of media is at the intersection of AI and gaming. AI is already reshaping content creation, with generative AI changing how information is finded and studios using it to streamline production.

Gaming is where AI’s impact is most dramatic. The global video game market is set to reach nearly $300 billion by 2029, larger than movies and music combined. AI is a key driver, reducing development costs and speeding up production. This efficiency is fueling an explosion in gaming advertising, with its share of total game revenue projected to hit 38.5% by 2029. AI-powered optimization makes these ads smarter and more profitable, creating unprecedented opportunities for companies that accept new technologies.

Enterprise SEO implications for large companies:

- Use AI to scale responsibly: accelerate briefs, clustering, and entity enrichment, then pair with expert review and unique first-party insights to maintain E-E-A-T. Understand the technology landscape via Generative artificial intelligence.

- Build findability for games and experiences. Create authoritative hubs for genres, franchises, characters, and guides. Implement relevant structured data (for example, VideoGame, HowTo) and leverage UGC thoughtfully for long-tail queries.

- Prepare for AI-in-search. Design content that answers user intent succinctly and with strong entities so it is quotable by AI summaries while still giving reasons to click through (tools, calculators, downloads, and interactive assets).

For insights on leveraging these trends, explore our AI-Driven Content Strategy and Emerging Trends in Entertainment and Media Industry resources.

How to Find and Leverage Actionable Media Insights

The media industry generates an overwhelming amount of data. The challenge is sorting through the noise to find insights that matter for your business. With the industry racing toward $3.5 trillion, access to a reliable media industry report isn’t just helpful—it’s essential for survival.

The difference between companies that thrive and those that merely survive often comes down to knowing where to look, how to analyze global patterns, and turning those insights into concrete business actions. A systematic approach is key. For more on how we approach this complex landscape, explore our Emerging Tech Insights.

From an enterprise SEO standpoint, your goal is to turn market signals into scalable search visibility: align keyword universes with audience needs, build high-authority content clusters, and engineer the technical foundation for findability across regions and devices.

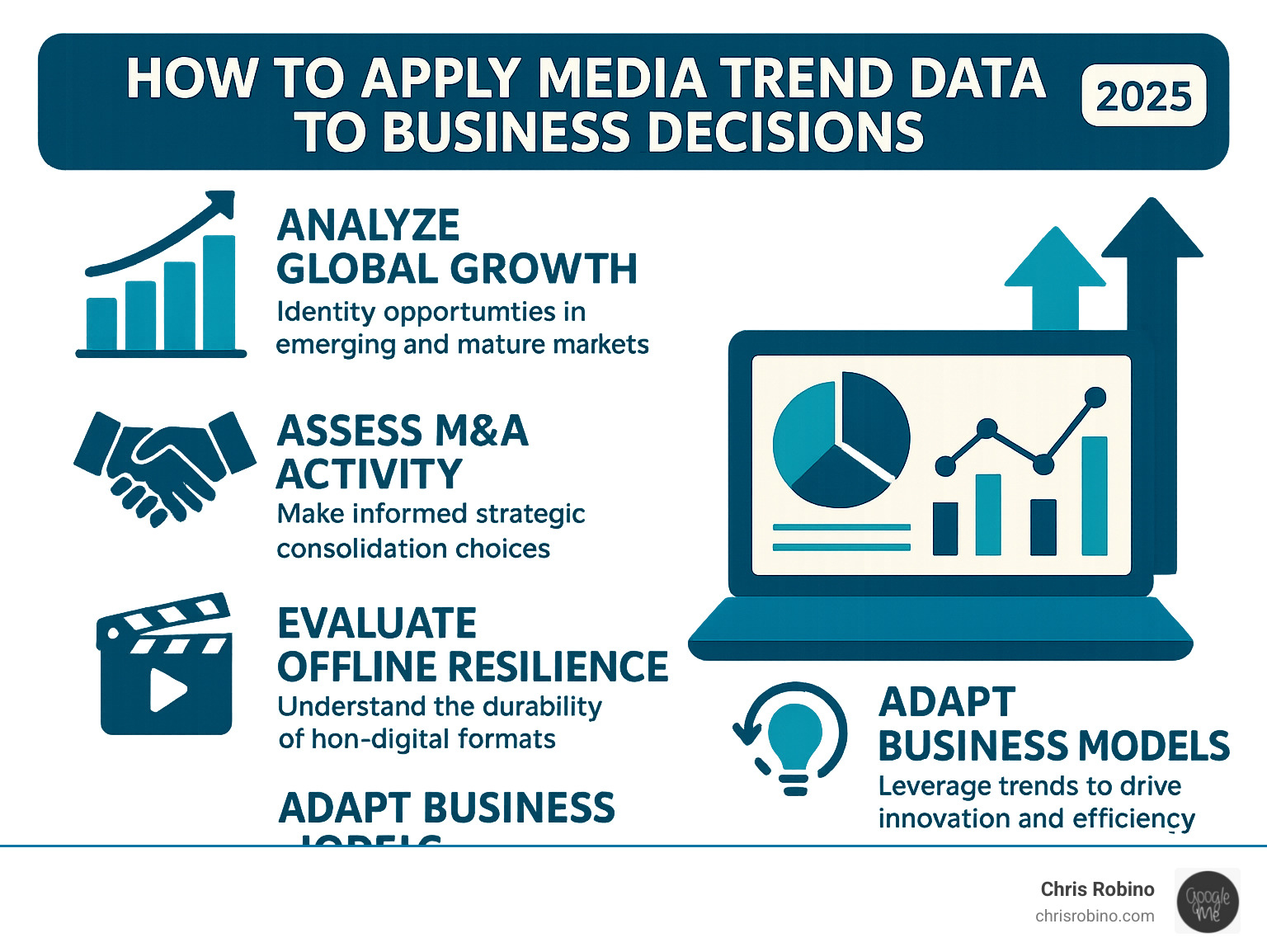

Analyzing Global Growth and Strategic Consolidation

Once you have solid data, the detective work begins. The media landscape moves at different speeds across regions, revealing where the biggest opportunities lie. Emerging markets are driving explosive growth. While the US market’s 3.8% growth is steady, it pales in comparison to India, Indonesia, and Saudi Arabia—all posting growth rates above 7.5%.

This geographic disparity is driving major strategic decisions, including a wave of mergers and acquisitions as companies bet big on content ownership and global reach. At the same time, offline entertainment shows remarkable resilience. Live music and global cinema are seeing revenues rebound, with box office spending expected to jump to $41.5 billion by 2029. Non-digital formats still account for the majority of consumer revenue, creating opportunities for companies that can bridge both worlds. These patterns guide how we help clients pursue Innovation in Media Companies.

Enterprise SEO actions that fit these realities:

- International SEO: use market-level demand data to prioritize launches; implement hreflang, localized metadata, and culturally relevant content; build in-country link equity via partnerships and PR.

- Site architecture for scale: create regional hubs with mirrored information architecture; avoid duplicate content pitfalls with canonicalization rules and language-region clarity.

- M&A and consolidation: plan domain migrations with redirect maps, log-file monitoring, and phased rollouts; align taxonomies and deprecate thin/duplicative templates to preserve and grow organic equity.

Applying Data to Your Business Change

The ultimate test of any media industry report is changing its insights into a competitive advantage.

The advertising gold rush means subscription services should diversify into ad revenue streams. The evolution of streaming demands flexible monetization, from AVOD to hybrid models. AI integration requires identifying specific workflow improvements that deliver measurable cost savings while addressing ethical considerations. Finally, global expansion into high-growth markets requires localized content and business models.

Enterprise SEO playbook to operationalize these insights:

- Technical excellence: monitor Core Web Vitals at template level; optimize rendering, image/video delivery, and crawl efficiency; instrument log-file analysis to remove crawl traps and prioritize high-value sections.

- Content at scale: build hub-and-spoke architectures for priority topics (streaming, gaming, CTV, retail media); develop programmatic pages responsibly with strong editorial quality and unique data; maintain expert review for E-E-A-T.

- Structured data: implement schema across products, articles, videos, how-tos, and events to open up rich results and improve entity understanding.

- SERP ownership: coordinate with paid teams on shared query clusters; defend branded terms while expanding non-brand coverage; create comparison, value, and where to watchassets.

- Measurement: define north-star KPIs (indexed pages-health, share of voice, qualified organic sessions, assisted revenue), and tie them to business outcomes via MMM/MTA.

- Governance: establish SEO guardrails, editorial guidelines, and release checklists so improvements persist across teams and vendors.

The key is staying agile. Our expertise in Business and Technology Consulting helps you interpret complex reports and implement strategies that turn insights into results. To steer these complex shifts and implement a winning strategy, explore our services in digital change for media.